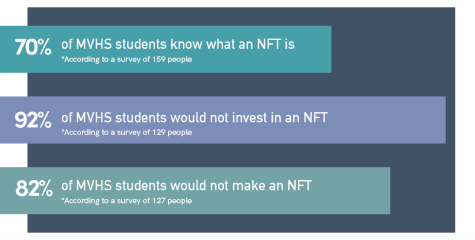

The Non-Fungible Takeover

Investigating the recent popularity of NFTs

March 11, 2022

From digital art to music to tweets, a variety of different media can be logged under one’s unique ownership using a unit of data known as a non-fungible token, or an NFT, which investors must buy using cryptocurrency. In the last few months, art pieces marketed as NFTs have taken the world by storm. The art can be screenshotted or copied and pasted, but the value of the original is not diminished, much like how the Mona Lisa can be photographed but retains its worth. Because of the unique coding involved in the trading of NFTs, the true original can always be identified.

NFTs have exploded in popularity — the art market, in particular, has reached almost $2 billion worth of sales since 2021. Junior Dillon Huang, co-president of the Art of Investing club, attributes the sudden growth of the NFT market to fervor influenced by celebrities, like Reese Witherspoon and Gwyneth Paltrow, who inspire their fans to also invest.

Nevertheless, NFTs are a controversial topic. An investor’s purchase must be coded on a recording system called a blockchain, a process that uses a large amount of energy. One artist’s NFTs have created over 160 tons of carbon dioxide emissions in under six months, equivalent to 24 years of electricity consumption for the average American.

Additionally, economics teacher Peter Pelkey believes that the NFT market is too volatile for any investment in it to be a reliable choice.

“Anything that goes up that fast will come down just as fast,” Pelkey said. “It’s better to put yourself into some steady investments. You don’t want to [risk] a big haul in one shot. That’s called gambling.”

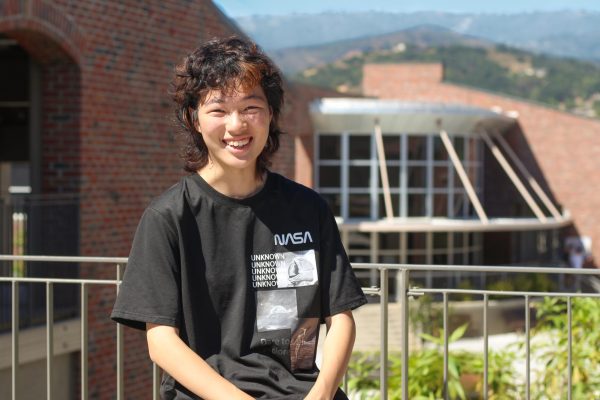

Along with their volatility, the NFT market has also been criticized for perpetuating art theft. Anyone can mint a file as an NFT regardless of whether it belongs to them, leading to many artists’ work being distributed on online marketplaces without their permission or even knowledge. Senior Olivia Tsui also denounces NFTs because of their exploitative nature towards artists.

“I think that they’re kind of the embodiment of capitalism,” Tsui said. “Really distilled down, it’s not in the best interest of artists or anyone to invest in them.”

Tsui believes that the negative impacts of NFTs, like the extreme climate damage they inflict and the lack of artistic integrity she believes they possess, outweigh any pros the digital token may have to offer.

“It doesn’t really have anything to do with creativity,” Tsui said. You’re attaching worth to an image [as if] the idea of ownership is more important than the enjoyment of creating art.”

Despite the plethora of controversies surrounding NFTs, Huang acknowledges that the market could be extremely profitable for young artists at MVHS who might “want to get into art to draw their own NFTs,” offering an incentive that could drive students to create.

Likewise, Pelkey states that for artists, social media is going to allow artists to “create more value” in their art, although he’s skeptical if it’ll work. However, he does believe that people are going to “create where the money is.”

“I’m sure there’s somebody out there at MV trying to figure out how to corner this market,” Pelkey said. “Because there are always kids looking for an angle. It’s kind of the MV way. Somebody might make some money out of this deal, but we’ll see.”

[/infographic