MV Microfinance presents Kiva charity proposal to the FUHSD Board

Officers propose plan to fund the club’s nonprofit loan company

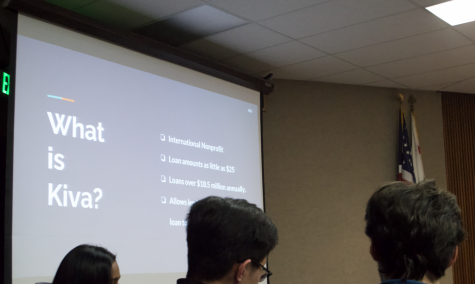

Sophomores and MV Microfinance officers Devin Gupta, Arnav Doshi, and Ojas Karnavat present their proposal to the FUHSD board to get their charity organization, Kiva, permanently approved for further use by the club throughout the year.

November 22, 2019

On Tuesday, Nov. 5, MV Microfinance president and sophomore Ojas Karnavat stood at the podium, joined by two other officers, to present a charity proposal to the FUHSD board. His goal was to have the Board approve the microfinance nonprofit organization Kiva, a nonprofit organization that lends money to businesses and other organizations around the world, which plays a crucial role in the club’s loaning process. Kiva was previously only temporarily approved by the board as a charity for MV Microfinance to work with, but the meeting on Nov. 5 was the final approval needed for the club to continue working with Kiva permanently.

As an online loaning service, Kiva provides money to low-income entrepreneurs. Lenders send donations to the organization through Kiva’s website, essentially giving anyone the chance to contribute. MV Microfinance makes donations to Kiva on a weekly basis after the club discusses which specific entrepreneur they wish to send their contributions to.

Before proposing the organization to the FUHSD Board, Karnavat created a presentation and speech with the help of sophomores Arnav Doshi and Devin Gupta, the MV Microfinance officers who presented with him at the meeting. The preparation took up to two weeks for the three of them, who were hopeful that Kiva would be approved because of the similarity of the organization’s goal to their own for the club — to be able to support businesses and entrepreneurs in need of financial support around the world.

According to Kiva’s website, Kiva has lent a total of $1.3 billion to over 80 countries. Because of Kiva’s extensive global reach and technological convenience, Karnavat and other members chose to work with the organization in hopes to achieve the club’s purpose. Because of Kiva’s unique goal, that Karnavat feels is very similar to MV Microfinance’s, he looks forward to working with the nonprofit permanently.

“[Kiva] is an impactful charity — it’s something different and we’re loaning compared to donating,” Karnavat said. “Kiva is an organization that needs to be a charity, because it’s different from all other organizations. I feel like we have everything necessary to make a good case to [the board].”

In the presentation, Karnavat, Doshi and Gupta emphasized the importance of Kiva to MV Microfinance, as well as the effectiveness and impact of Kiva all over the world, because it connects them with clients who need to borrow money all over the world. After a few brief questions by the board members, Kiva was unanimously approved, allowing MV Microfinance to utilize the nonprofit throughout the year as their means of lending money.

After a presentation explaining the purpose of MV Microfinance and Kiva, the FUHSD board unanimously voted to approve the club’s future work with the organization. Photo by Ishaani Dayal

As the 2019 Student Representative on the FUHSD board, senior Dan Sachs participates in board meetings to report the student activities in all high schools in FUHSD. His role gave him a firsthand experience of MV Microfinance’s presentation to the board.

Sachs was impressed by the club’s proposal, and felt that the experience of presenting to the board was beneficial to Karnavat, Gupta and Doshi. The approval of their proposal was a good outcome to their future endeavors according to Sachs, and he believes that the officers received a valuable experience as well.

“I was really happy to see that they presented and were able to express to the board why [Kiva] deserves their fundraising,” Sachs said. “It’s great to see them have that interaction of being able to present in front of a group of adults, which is something that students don’t always do. It was cool to see that they could answer the questions. They were knowledgeable about the club and about the charity.”

After presenting, Doshi was also satisfied with the club’s proposal to the board. He feels that they were well prepared and made a compelling presentation, believing that the good cause Kiva brings would have won the board members over either way.

“I think we got our point across based on what the club is doing, what cause we’re working for: helping people in third world countries that would need money to run their businesses and get a reliable income,” Doshi said.

As a board member, Sachs feels that the practicality and advantages of Kiva for MV Microfinance and the club’s benefactors across the world were understood by other board members and impacted their decision to approve the organization.

“[The board] didn’t necessarily know about MV Microfinance, but they thought it was really cool that students on our campus were able to help people in different countries or in different places around the world just by donating a smaller amount,” Sachs said. “And so I think they thought it was really cool that this is something that students have an opportunity to do and to talk about.”

So far, the club’s efforts have been more impactful outside of Cupertino, felt by the countries with entrepreneurs who MV Microfinance have donated to. Karnavat reports that MV Microfinance has lent $1,200 to 27 countries in its time as a club at MVHS and hopes to continue growing with the help of the Cupertino community. In the future, he believes that the club could have a strong impact on the world.

“Our impact is, of course, in those 27 countries, [not] Cupertino,” Karnavat said. “But I feel like the idea of [the] Microfinance [club] is not something many people even in this area know about. So in Cupertino, we’re hoping to do more events so that the general public, especially parents, can know what Microfinance is and help out in expanding Microfinance as a whole.”