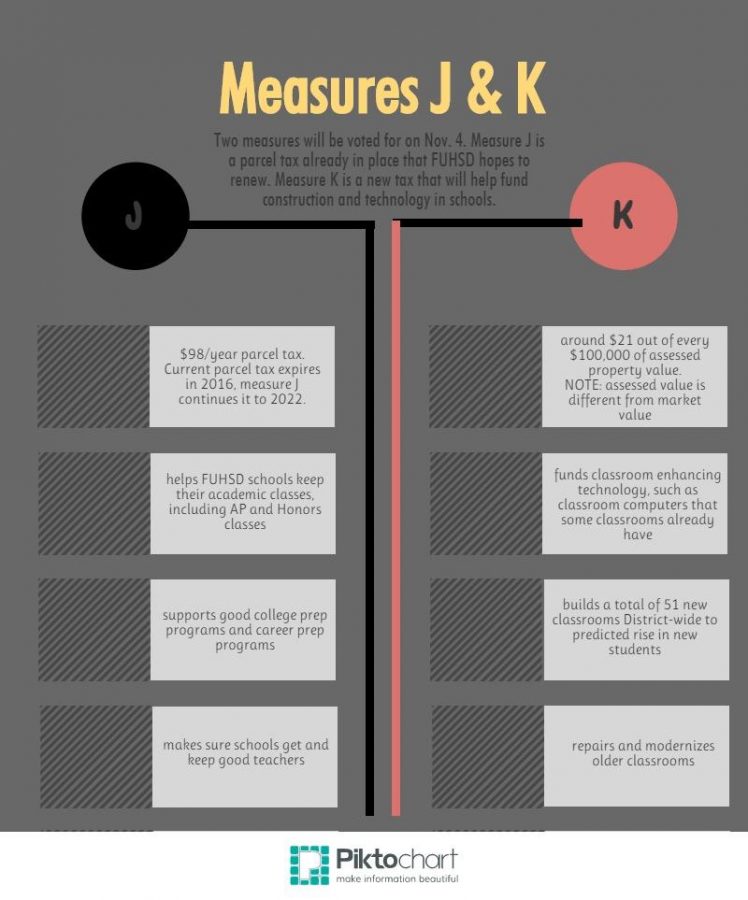

This year FUHSD hopes to pass a tax for additional facilities for schools, known as measure K, in addition to renewing the parcel tax that covers yearly school costs, known as measure J. Phone banking took place on Wednesday, Oct. 22, to inform citizens of measures J and K. Voting to renew measure J and pass measure K a will take place on Nov. 4.

El Estoque: Can you give us a brief explanation of measures J and K?

Diana Goularte: The J measure is a parcel tax renewal of the current $98 parcel tax. It can be used for programs and for attracting and retaining high quality teachers and staff. K is a bond measure that is $21 for every $100,000 of assessed value. It can be used for upgrading facilities, maintenance for infrastructure, basically, the properties of the school.

EE: What would the money from the measure K tax be spent on?

DG: It would fund projects that we built on the last bond. We have other projects on a wishlist; for example, a performing arts center. Some of it is not as glamorous. It’s infrastructure, replacing pipes, because buildings get older and must be updated and maintained. So, some types of things are not as grand as getting a new building.

EE: Does the current parcel tax (measure J) not cover any of this?

DG: The regular parcel tax covers expenses that we have every year. We have payroll expenses, program expenses and extra things like guidance counselors, guidance support, career center support; things that some people believe are not crucial to classroom instruction, but we believe they’re a huge part of making the school the special place it is.

EE: Considering that Measures J and K are for the entire school district, how much will be used for MVHS?

DG: Our projects will be based on what the priorities are for the whole district. In the last bond, there were some schools that had projects we couldn’t get to, so those would have higher priority than the projects here because MVHS has been fortunate enough to get a new library and a new student center.

EE: These measures affect will be taxing everyone, not just citizens with children going to FUHSD schools, right?

DG: Senior citizens can vote yes on the parcel tax but be exempted from the parcel tax. They just need to file for an exemption if they’re over 65. Many senior citizens have a fixed income, and they find it a financial hardship to pay the $98 fee. As for the people who don’t have students in high school and feel that they don’t benefit from approving the parcel, I try to talk to them and mention that high-performing schools are really good for property values and let them know that even though they may not have a student in school, it’s important for the community to have high-performing schools to make it a desirable place to live in.